Last month, I shared this Good Advice blog post encouraging nonprofit organizations to celebrate tribute gifts and intentionally promote them during calendar year-end and beyond. That piece was inspired by a client project—and by a data point from Nonprofit Tech for Good showing that while 46% of online donors make tribute gifts, only 19% of nonprofits actively encourage them. That gap is a huge opportunity for mission-driven organizations.

What I didn’t know then was how personally I would experience this advice from a donor’s perspective just a few weeks later when I learned that not all online giving opportunities are created equal.

As part of our 2025 year-end giving, my husband and I made a list of five memorial gifts we wanted to give in honor of friends and family members we lost last year. Each honoree’s family had identified a nonprofit close to their loved one’s heart, so five times, I visited different nonprofit websites to make five separate online memorial gifts.

Each time, I hoped for a straightforward experience:

• Make a one-time tribute gift,

• Receive a timely tax receipt, and

• Know that an acknowledgment would be sent to the family.

Those are simple expectations, yet my donor journey varied dramatically from one site to the next. Based on those experiences, here is some good advice to help you create an excellent, donor-friendly process for online tribute gifts. Please forward to your development department if you are not the one responsible for fundraising for your organization.

1. Make Tribute Giving Easy to Find

Donors shouldn’t have to hunt for tribute-giving options. Be sure your donation page includes a clearly marked “Tribute Gift” or “In Honor/In Memory” option, and a brief explanation of how tribute gifts are handled.

2. Keep Tribute Fields Simple and Intuitive

If the form is too long or confusing, donors will drop off. Request only essential information: the honoree’s name, honor/memory designation, and the notification recipient’s contact details.

3. Give Donors Certainty About the Tribute Notification

The number one question tribute donors have is: “Will the family actually know about my gift?” Ease that stress by confirming how the notification will be sent and to whom. Peace of mind builds trust.

4. Deliver the Tax Receipt Immediately

Provide an instant email receipt with a clear subject line and tribute details included. Professional, timely receipts reassure donors that their gift was processed correctly.

5. Add a Personal Touch to the Acknowledgment

Tribute gifts are emotional. Even a brief, warm acknowledgment leaves a strong impression and deepens donor connection.

6. Test Your Online Tribute Giving Experience Twice a Year

Have staff make small test gifts (one honor, one memorial) to review form usability, receipt timing, and notification accuracy. This simple internal check prevents donor frustration and lost gifts.

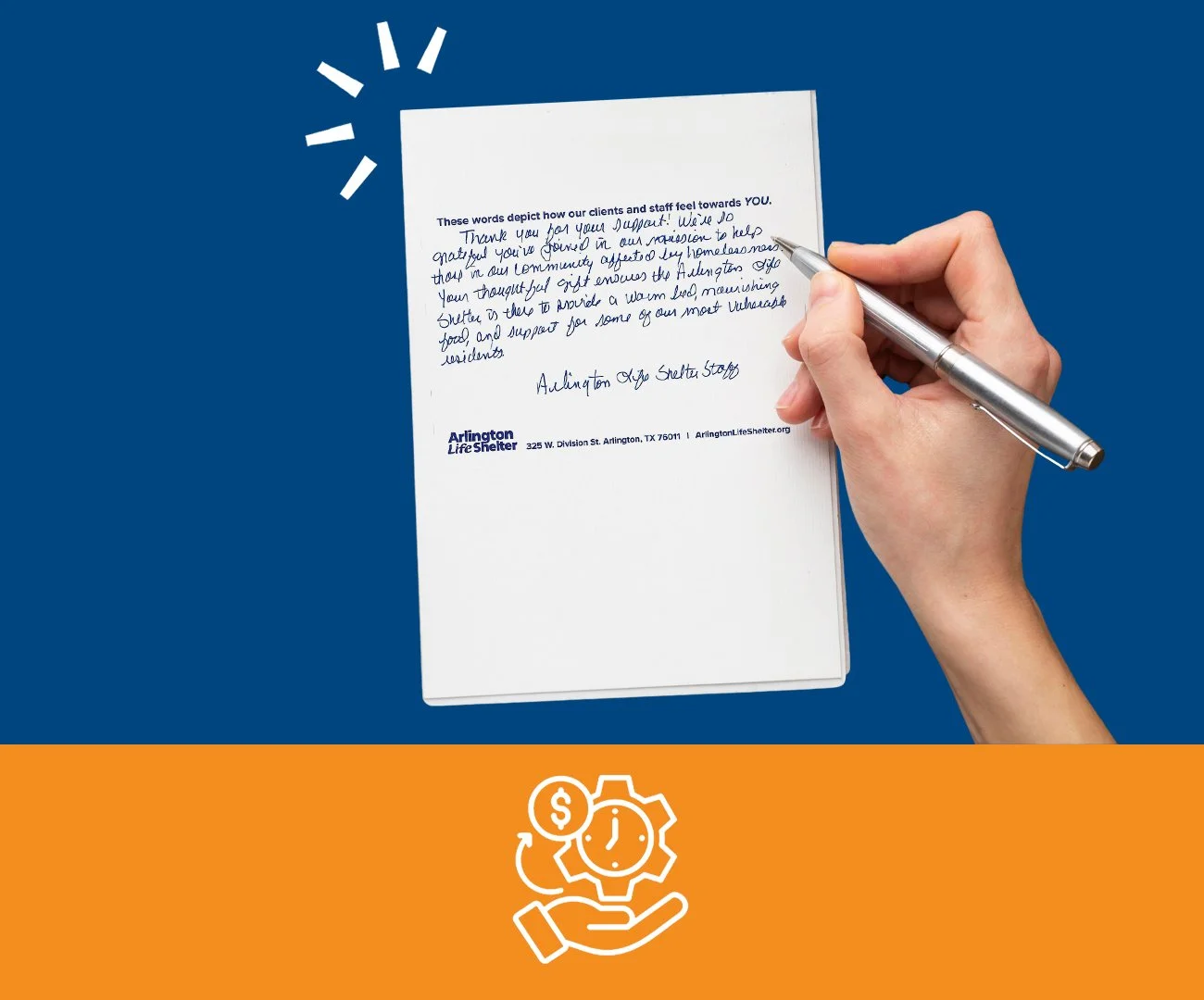

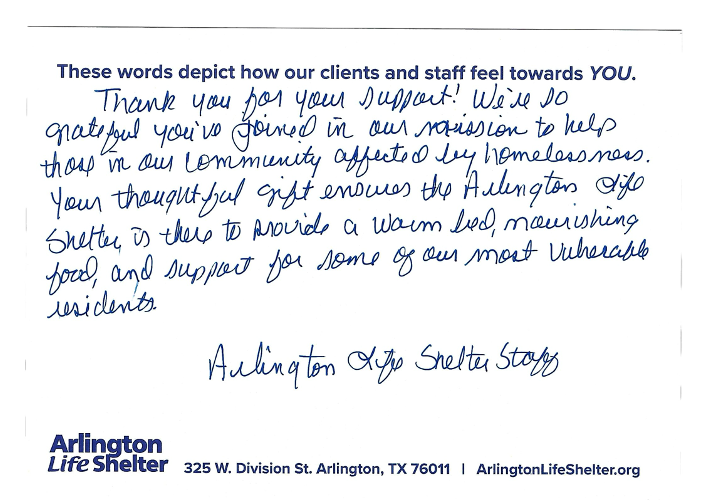

A Standout Example: Arlington Life Shelter

Among the five online tribute gifts I made in December, Arlington Life Shelter stood out. In addition to a simple process, an immediate receipt by email, and a personalized mailed letter signed by the President and CEO, they sent a handwritten thank-you note to our home.

(Image: Handwritten thank-you note from Arlington Life Shelter)

What made this especially meaningful is that our gift was modest, yet it received the level of care typically reserved for major gifts. Kudos, Stephanie, Bertha and team!

Final Thought: Don’t Miss Valentine’s Day Tribute Opportunities

As you look ahead this month, consider how you might encourage tribute gifts for Valentine’s Day. It’s a natural moment to invite your community to honor someone special while making an impact – and the perfect time to ensure your online giving process delivers a smooth, heartfelt donor experience. The donors - and the families of the honorees - will feel the love.

If you missed the first part of this series, you can catch it here, along with other good advice for advancing your community cause. Let us know how we can help!